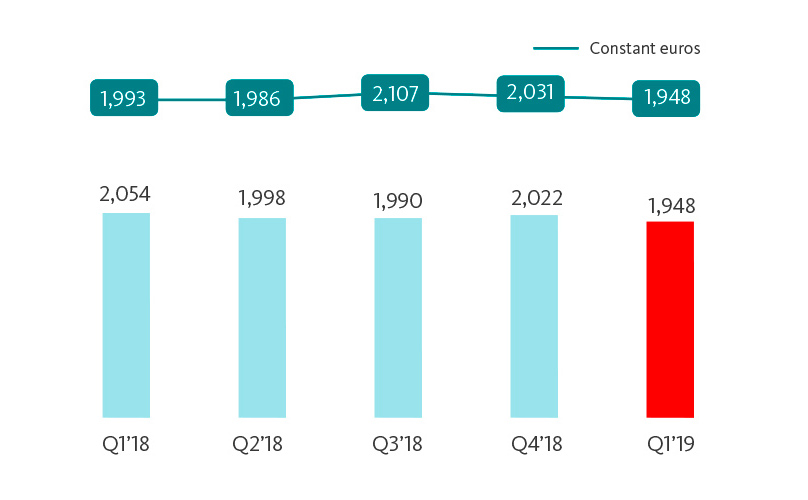

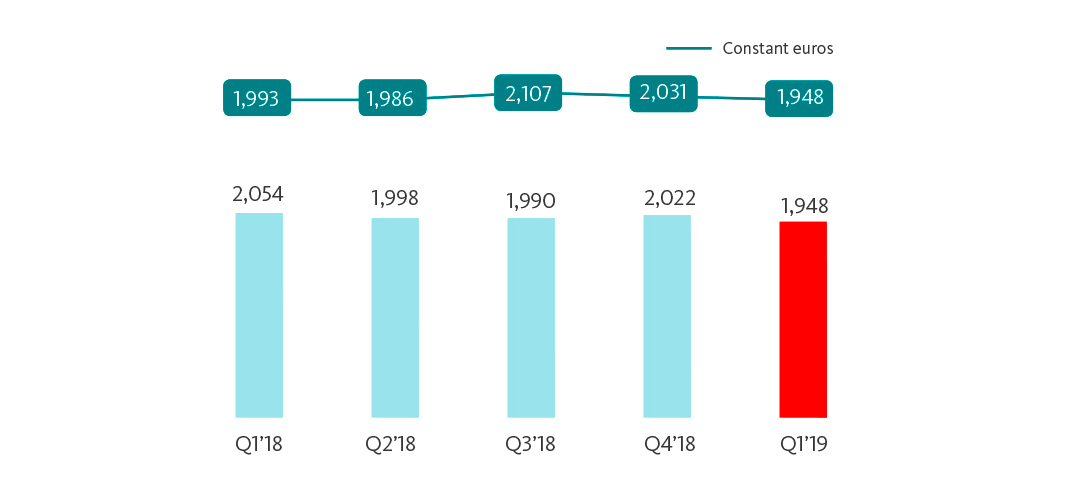

First quarter attributable profit of EUR 1,840 million, after recording net charges of EUR 108 million (net of tax).

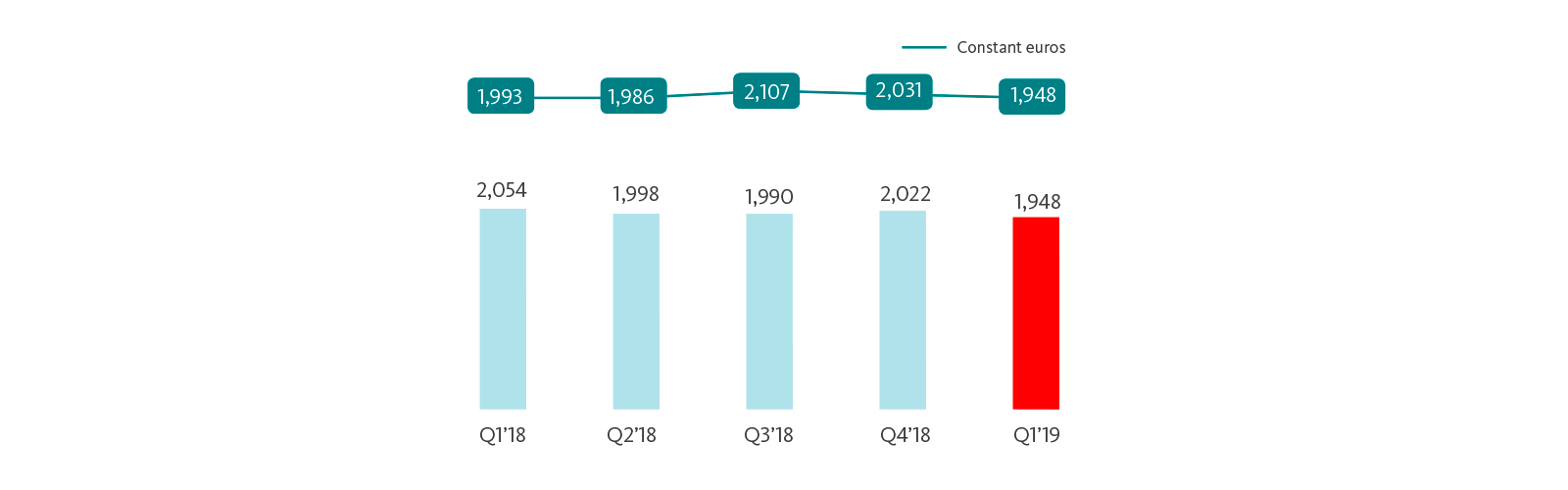

Excluding these charges, underlying profit was 5% lower than in the first quarter of 2018 (-2% in constant euros). This result was affected by the negative performance of markets in the first quarter, the impact of applying IRFS 16 and the high inflation adjustment in Argentina.

The underlying P&L trends remained solid, with: