Business model

1. Our scale

Local scale and leadership. Worldwide reach through our global businesses.

1. Market share in lending as of December 2020 including only privately-owned banks. UK benchmark refers to the mortgage market. DCB refers to auto in Europe.

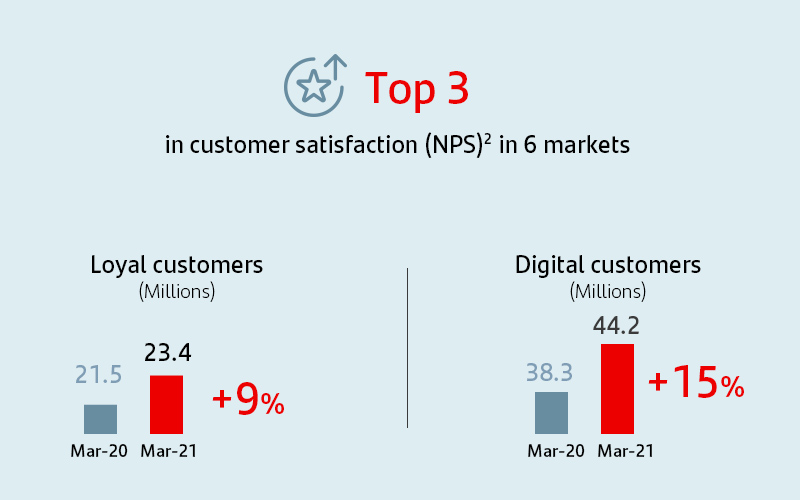

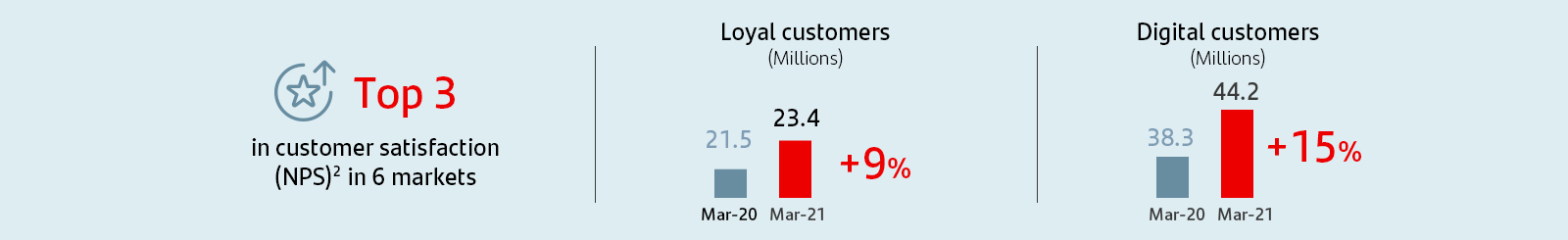

2. Customer focus

Unique personal banking relationships strengthen customer loyalty.

2. NPS – Customer Satisfaction internal benchmark of active customers’ experience and satisfaction audited by Stiga / Deloitte.

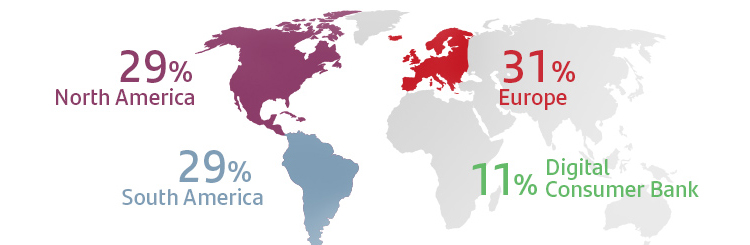

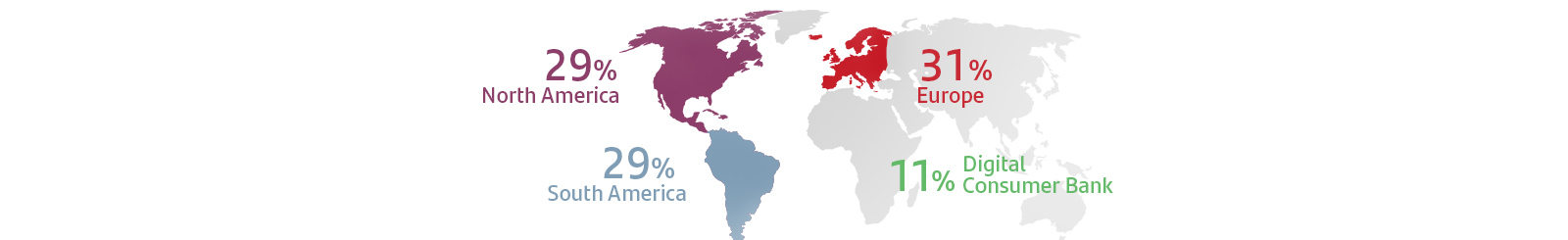

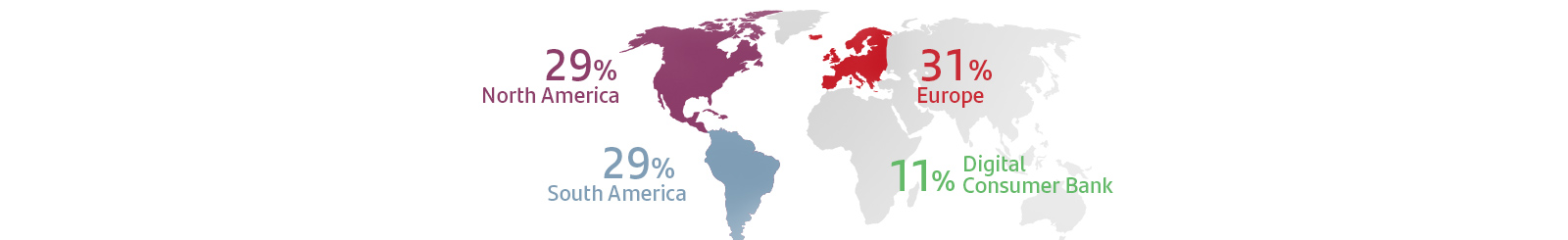

3. Diversification

Our geographic and business diversification makes us more resilient under adverse circumstances.

- Geographic diversification3. Balanced between mature and emerging markets.

- Business diversification between customer segments (individuals, SMEs, mid-market companies and large corporates).

3. Q1'21 underlying attributable profit by region. Operating areas excluding Corporate Centre.

The Santander Way remains unchanged to continue to deliver for all our to stakeholders.

Our purpose

To help people and businesses prosper.

Our aim

To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities.

Our how

Everything we do should be Simple, Personal and Fair.