ACTIVITY

Customers

- In the current environment, digital penetration is accelerating. We reached almost 40 million digital customers (+15% year-on-year), mobile customers exceeded 32 million (+5.8 million in 12 months) and digital sales represented 47% of total sales in the quarter (36% in 2019).

- Loyal customers rose nearly 1 million year-on-year, with growth both in individuals and corporates.

Digital customers

Millions

Digital sales

% of total sales

- In the second quarter, the Group continued to provide significant financial support to customers to help them overcome the consequences of the pandemic.

- We are starting to see signs of normalisation in lending trends with mortgage and consumer lending recovering in June. The SME and corporate segments, backed by government-guaranteed programmes, and CIB decreased from the peak in April.

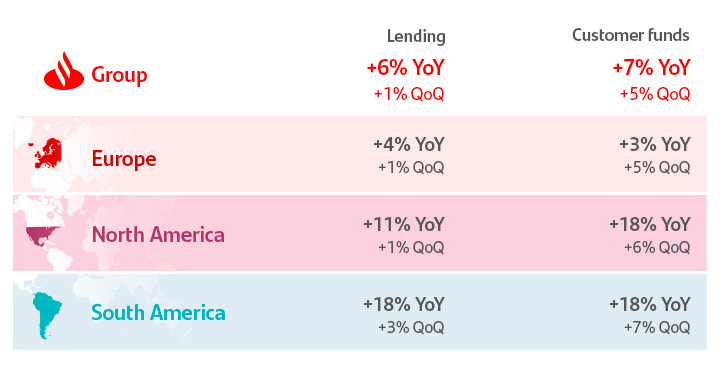

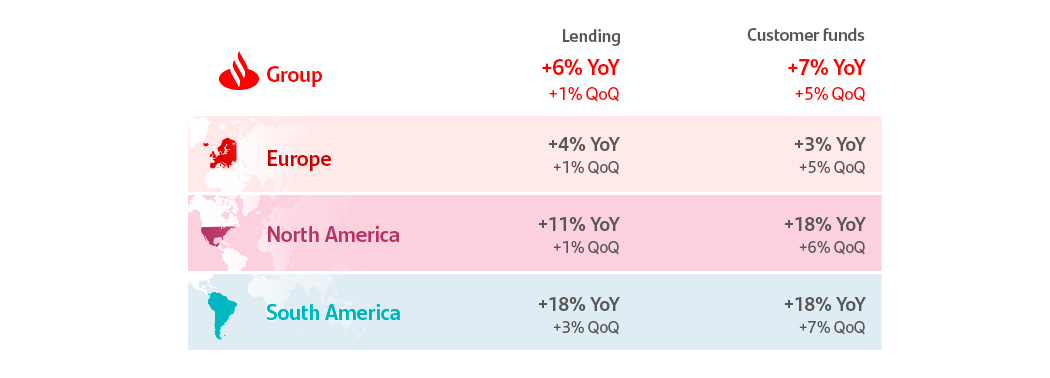

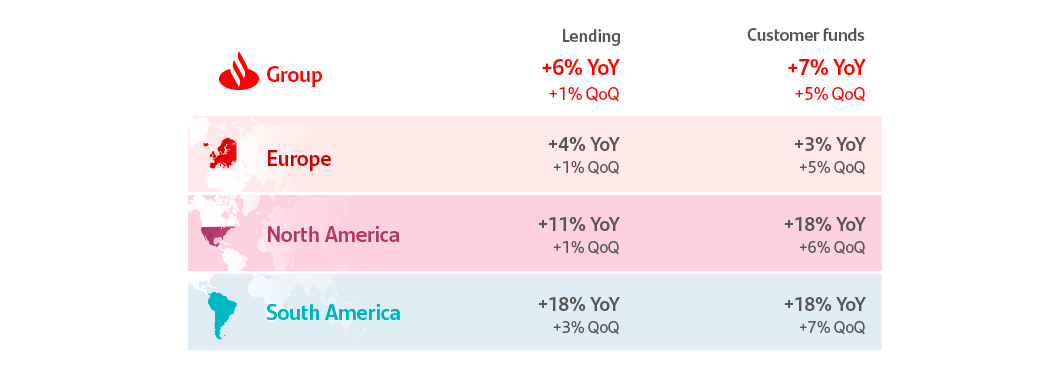

- On a year-on-year basis, strong negative exchange rate impact (-5/-6 pp). In constant euros, gross loans and advances to customers (excluding reverse repos) grew 6% and customer funds (excluding repos) rose 7%, both with the 10 core markets growing, except customer funds in Spain.

Note: Jun-20 changes in constant euros. Loans and advances to customers excluding reverse repos. Customer funds: customer deposits excluding repos + marketed mutual funds.

Business distribution by markets

% operating areas. June 2020EUROPE

| Loans to customers | Customer funds | |

|---|---|---|

| SPAIN | 23% | 33% |

| SCF | 11% | 4% |

| UK | 27% | 22% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 4% |

| OTHER EUROPE | 5% | 3% |

NORTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| USA | 11% | 9% |

| MEXICO | 3% | 4% |

SOUTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| BRAZIL | 7% | 10% |

| CHILE | 4% | 4% |

| ARGENTINA | 1% | 1% |

| OTHER SOUTH AMERICA | 1% | 1% |

| Customers funds 1% |

Activity

EUR million| % change vs H1'19 | |||

|---|---|---|---|

| H1'20 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 909,098 | 1.1 | 6.2 |

| Customer deposits** | 806,350 | 3.4 | 8.5 |

| Mutual funds | 152,040 | (12.8) | (0.8) |

| Customer funds | 958,390 | 0.5 | 6.9 |

**Excluding repos.