As a result of the worsening economic outlook, adjustments to the goodwill ascribed to some units and to deferred tax assets have been made totalling EUR 12,600 million, which results in an attributable profit to the Group of negative EUR 10,798 million.

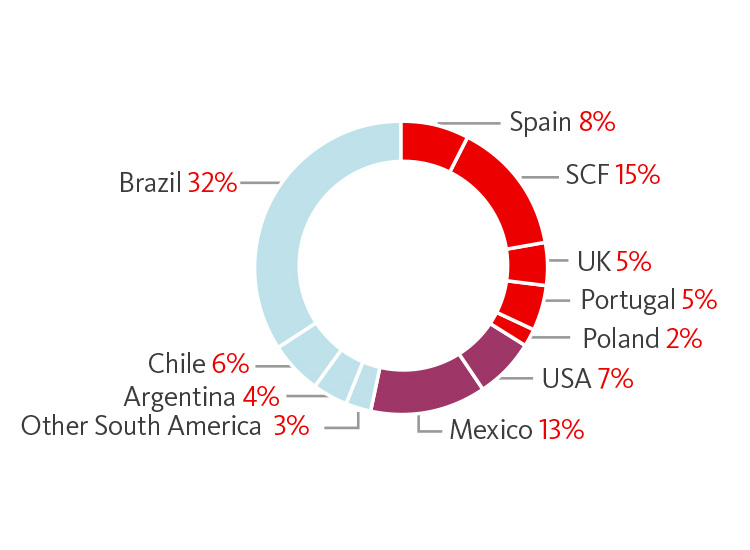

This adjustment has no impact on the Bank's liquidity or market and credit risk position, is neutral in CET1 capital and do not change the strategic importance of any of the Group's markets. The Group remains confident in the potential for the long-term value creation in each of its regions and markets.

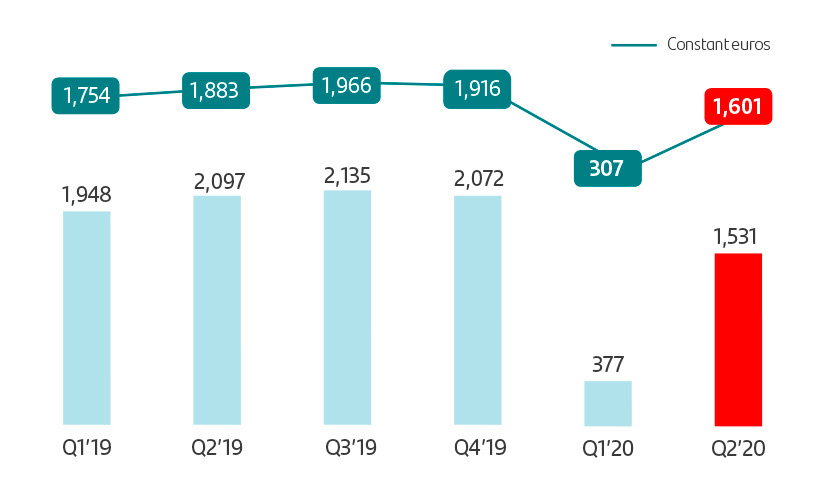

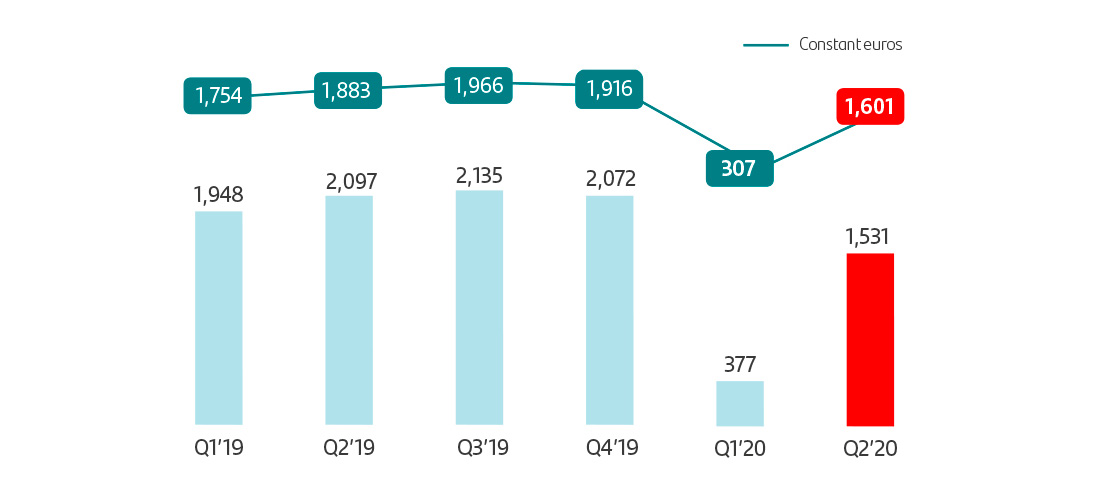

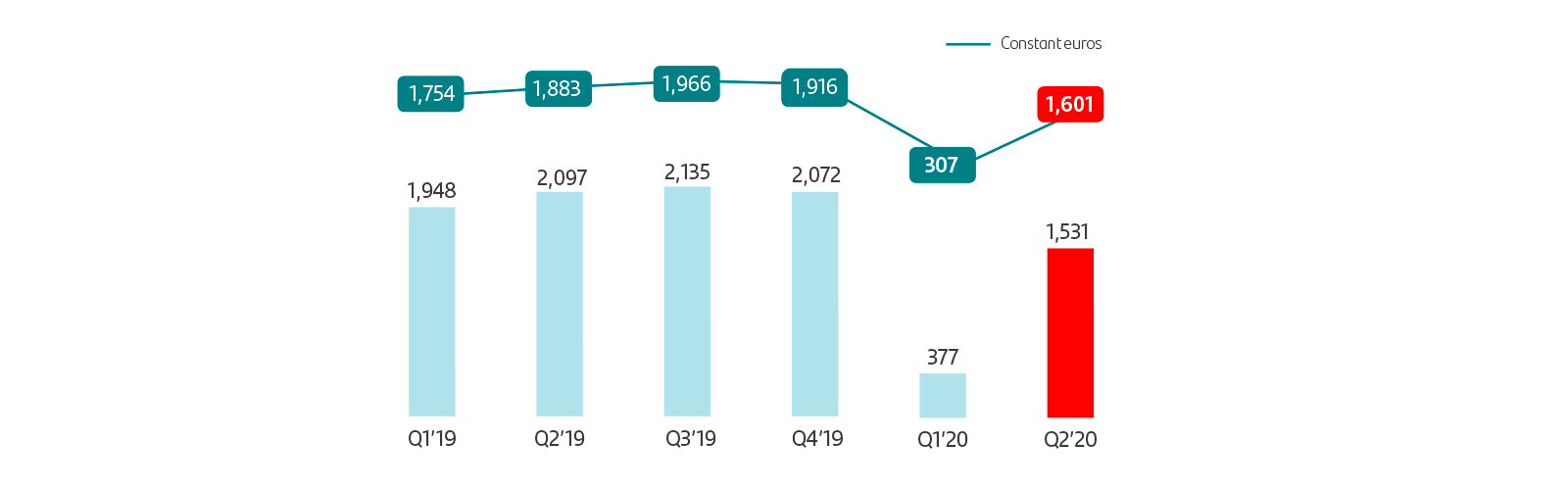

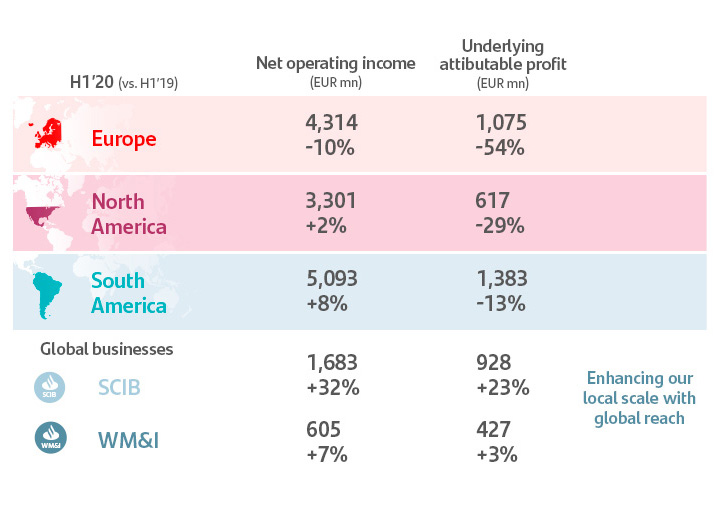

Excluding the above adjustments and restructuring costs, underlying attributable profit would have been EUR 1,908 million, 53% less than in the same period of 2019 (-48% excluding the exchange rate impact), with net operating income of EUR 11,865 million, 2% more without the exchange rate impact than at the end of the first half of 2019.