Customers

The Group’s strategy is driving growth in loyal and digital customers:

- Santander’s strategy continued to focus on boosting the loyalty of our customers. Their number rose again in the fourth quarter and reached 21.6 million, 1.7 million more in the year (+9%), with growth in both individuals and companies.

- The faster pace of digitalisation is reflected in the growth in digital customers, whose number increased by 4.8 million in the year (+15%) and in greater activity. On average, our customers accessed digital touchpoints five times per week and digital sales represented 36% of total sales, rising 4 percentage points in the year.

Loyal customers

(millions)

Digital customers

(millions)

Santander maintained its business growth across almost all markets

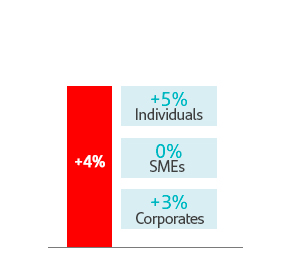

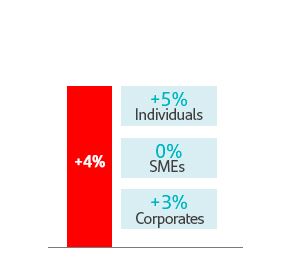

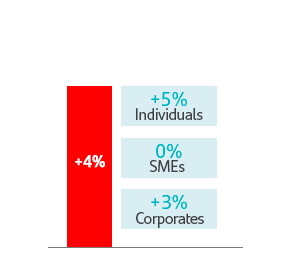

- Loans to customers rose 5% year-on-year (+4% in constant euros), with eight of the 10 core countries growing, particularly in North and South America, which grew 10% and 9%, respectively.

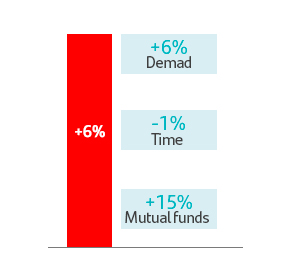

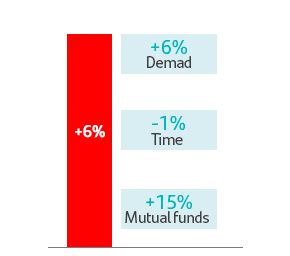

- Customer funds increased 7% year-on-year (+6% in constant euros), with growth in nine of our 10 core markets. Demand deposits increased, as well as mutual funds.

ACTIVITY

Dec'19 vs Dec'18. % CHANGE IN CONSTANT EUROS

Gross loans and advances to customers excluding reverse repos.

Customer deposits excluding repos + mutual funds.

Business distribution by markets

% operating areas. December 2019EUROPE

| Loans to customers | Customer Funds | |

|---|---|---|

| SPAIN | 21% | 32% |

| SCF | 12% | 4% |

| UK | 27% | 23% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 4% |

| OTHER EUROPE | 4% | 2% |

NORTH AMERICA

| Loans to customers | Customer Funds | |

|---|---|---|

| USA | 10% | 7% |

| MEXICO | 4% | 4% |

SOUTH AMERICA

| Loans to customers | Customer Funds | |

|---|---|---|

| BRAZIL | 9% | 13% |

| CHILE | 4% | 4% |

| ARGENTINA | 1% | 1% |

| OTHER SOUTH AMERICA | 1% | 1% |

| Customer Funds 1% |

Activity

EUR MILLION| % change vs 2018 | |||

|---|---|---|---|

| 2019 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 918,757 | 5.1 | 3.9 |

| Customer deposits** | 785,454 | 5.0 | 4.0 |

| Mutual funds | 180,405 | 14.3 | 14.7 |

| Customer funds | 965,859 | 6.7 | 5.9 |

**Excluding repos.