Attributable profit of EUR 6,515 million in 2019, 17% less than in 2018, after recording net charges that are outside the ordinary course performance of our business amounting to EUR -1,737 million (mainly the UK goodwill impairment, as well as restructuring costs in several markets and other provisions) and to EUR -254 million in 2018.

Excluding these results, the underlying attributable profit was EUR 8,252 million, 2% more than in 2018 (+3% excluding the exchange rate impact).

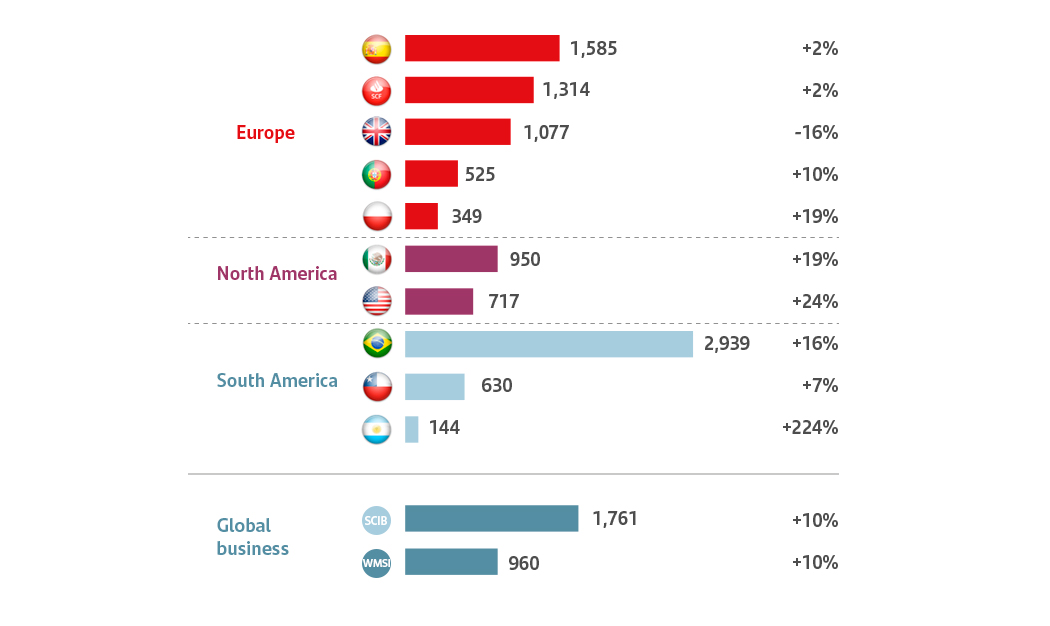

In a context of lower growth and interest rates, the underlying trends of the P&L remained solid: