ACTIVITY

Customers

- In the current environment, Santander’s strategy continues to focus on providing the best service to our 21.5 million loyal customers, whose number rose 1.2 million year-on-year (+6%), with growth both in individuals and corporates.

- The number of digital customers and activity grew at a faster pace (+1.5 million in the quarter, +4.4 million year-on-year), as digital sales represented 43% of total sales in March, rising 7 percentage points compared to 2019.

Loyal customers

(millions)

Digital customers

(millions)

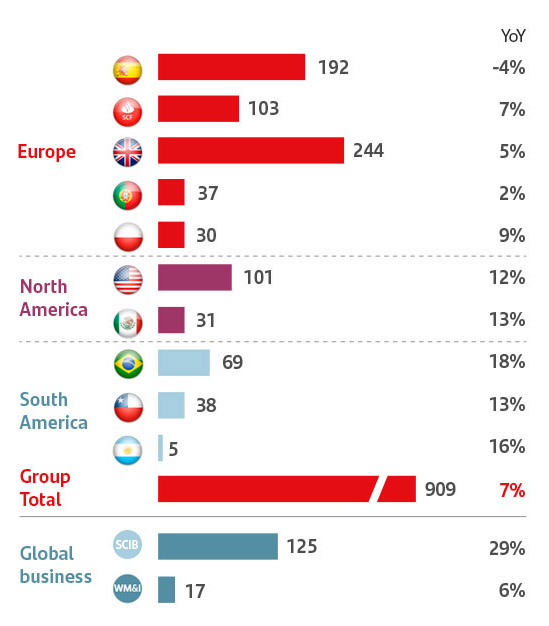

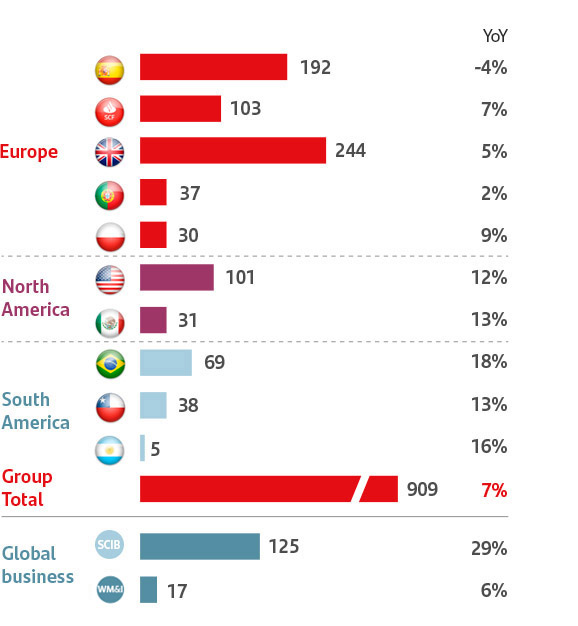

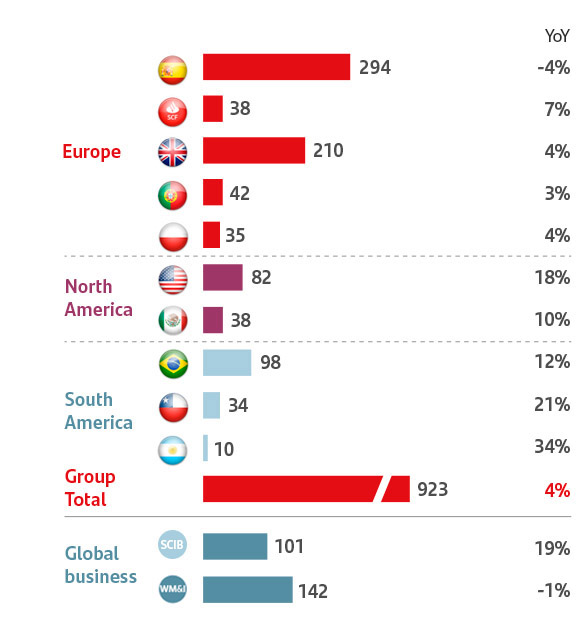

- Loans to customers excluding reverse repos rose 7% year-on-year in constant euros with nine of the 10 core markets growing particularly in South America (+16%) and North America (+13%), following strong growth in the quarter.

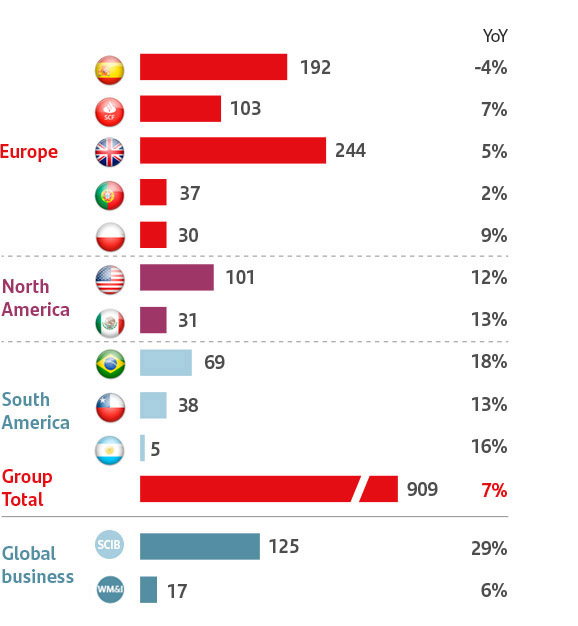

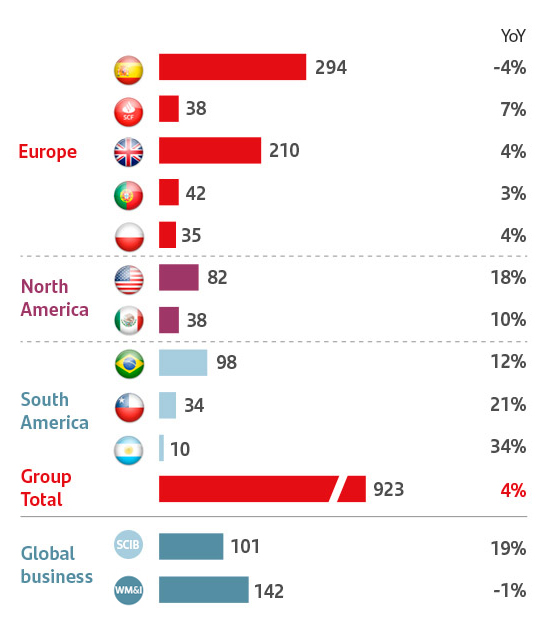

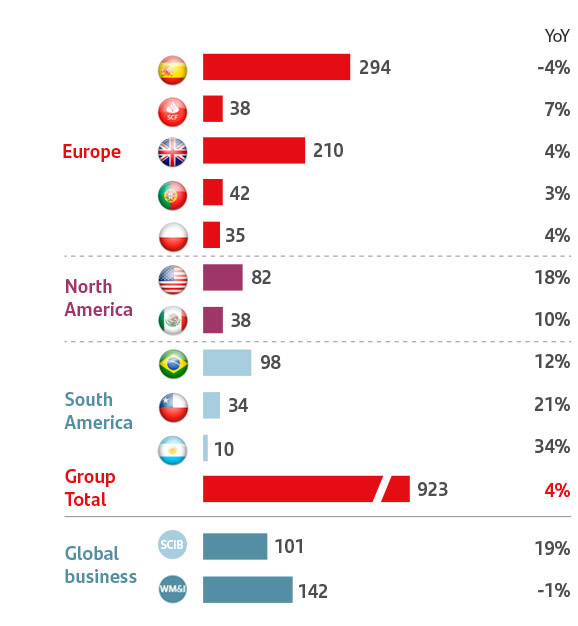

- Customer funds increased 4% in constant euros, driven by deposits excluding repos, which rose 6%. Growth in nine of our 10 core markets.

Positive trend across regions and global businesses accelerating in March, mainly due to the financing needs of companies

Mar-20 Loans and advances to customers

EUR bn and % change in contant EUR

Mar-20 Customer funds

EUR bn and % change in contant EUR

Note: Loans and advances to customers excluding reverse repos. Customer funds: customer deposits excluding repos + marketed mutual funds

Europe includes Rest of Europe (mainly SCIB) with loans: EUR 47 bn (+37% YoY).

Business distribution by markets

% operating areas. March 2020EUROPE

| Loans to customers | Customer funds | |

|---|---|---|

| SPAIN | 21% | 32% |

| SCF | 12% | 4% |

| UK | 27% | 23% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 4% |

| OTHER EUROPE | 5% | 3% |

NORTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| USA | 11% | 9% |

| MEXICO | 3% | 4% |

SOUTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| BRAZIL | 8% | 10% |

| CHILE | 4% | 4% |

| ARGENTINA | 1% | 1% |

| OTHER SOUTH AMERICA | 1% | 1% |

| Customer funds 1% |

Activity

EUR million| % change vs Q1'19 | |||

|---|---|---|---|

| Q1'20 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 909,108 | 1.5 | 6.5 |

| Customer deposits** | 775,069 | 1.0 | 5.8 |

| Mutual funds | 148,003 | (11.8) | (2.0) |

| Customer funds | 923,072 | (1.3) | 4.5 |

**Excluding repos.