First quarter attributable profit to the parent of EUR 331 million, including a net negative impact of EUR 1,646 million that is outside the ordinary course performance of our business, of which EUR 1.6 billion corresponds to the creation of a provisions overlay based on the expected deterioration of the macroeconomic conditions arising from the health crisis.

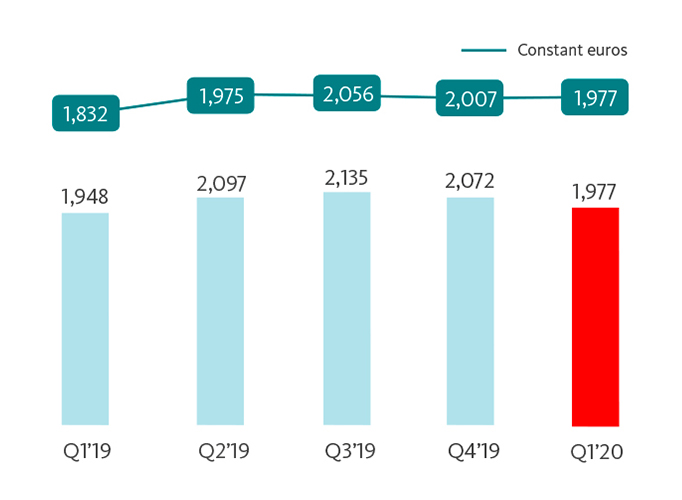

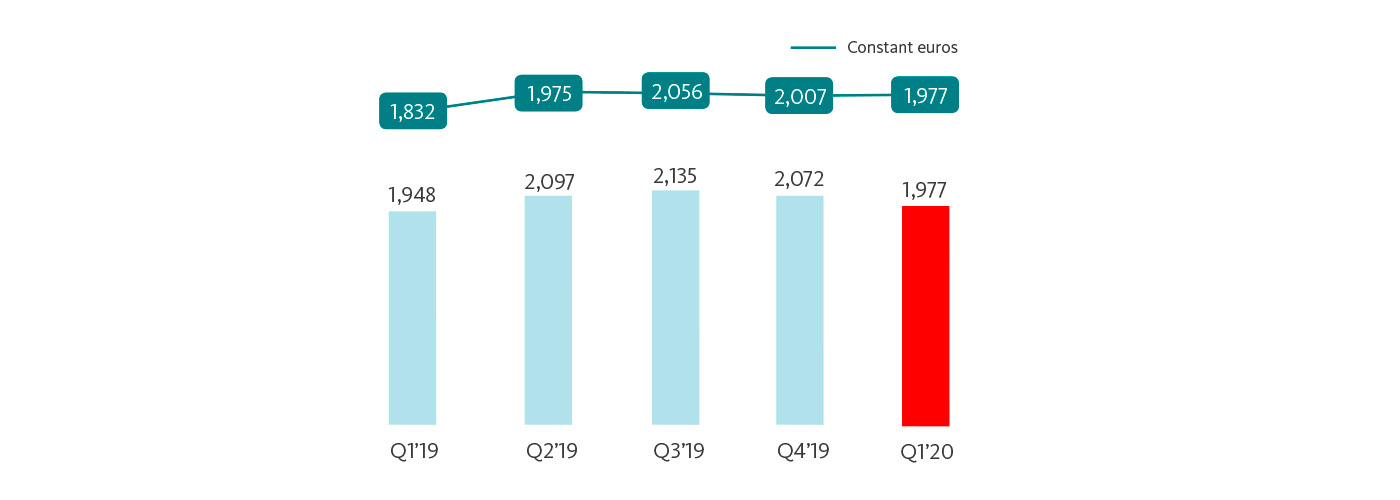

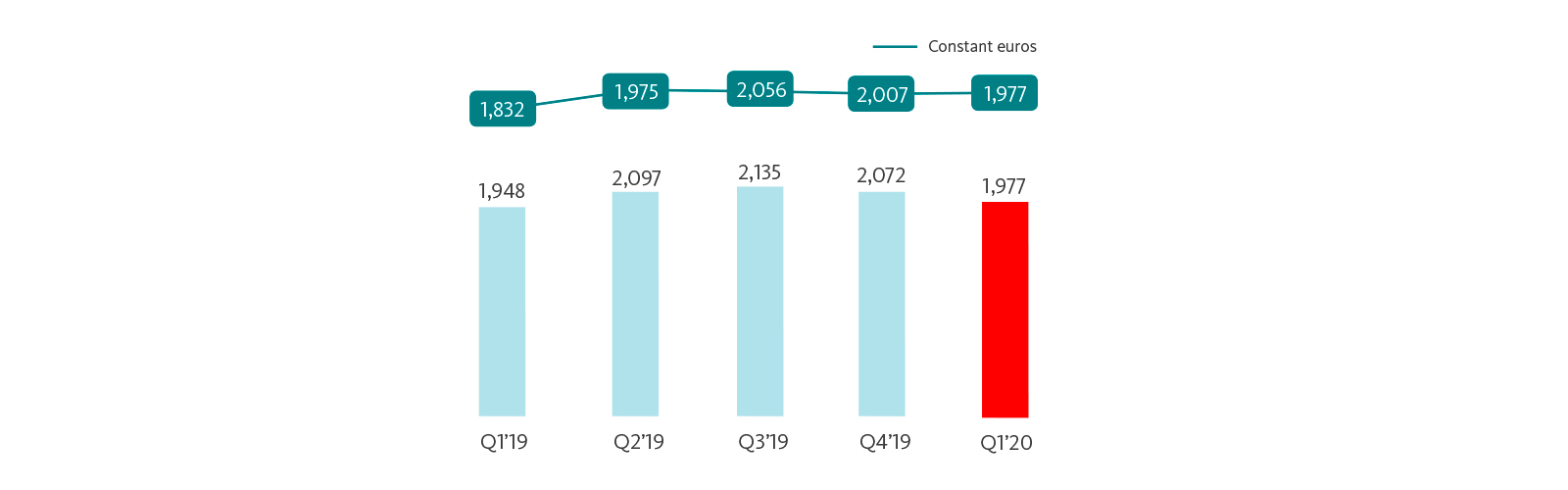

Excluding these charges, underlying attributable profit of 1,977 million euros, 1% more than in the same period of 2019 (+ 8% without exchange rate impact).

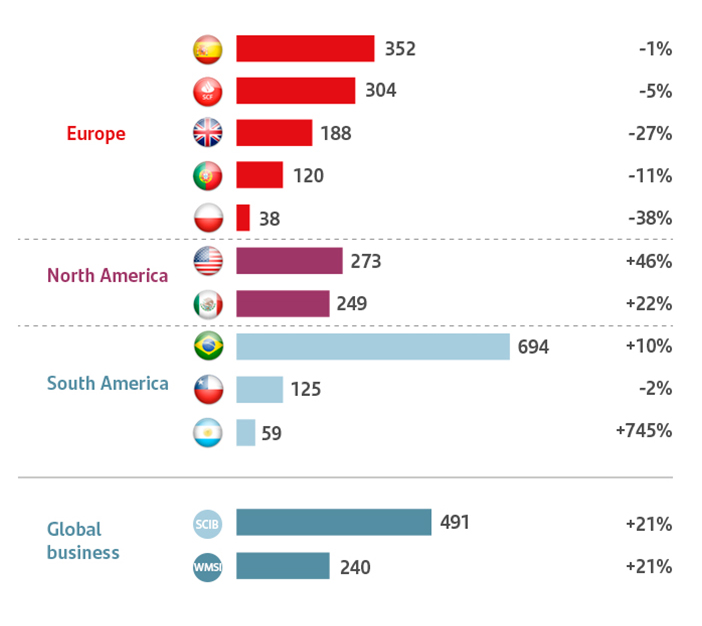

Results, marginally affected by the crisis, continued to reflect a solid underlying trend in constant euros: