ACTIVITY

Customers

- Digital penetration maintained an upward trend. We have more than 41 million digital customers (+5 million year-on-year), mobile customers reached more than 34 million (+5.9 million in 12 months) and digital sales up to September represented 44% of total sales (36% in 2019).

- Loyal customers rose 1 million year-on-year, with growth both in individuals and corporates.

Digital customers

Millions

Digital sales

% of total sales

- In the third quarter, the Group continued to provide the necessary financial support to customers to help them overcome the consequences of the pandemic.

- We continued to see signs of normalisation in new lending trends in the quarter, with mortgage and consumer lending recovering and reductions in the SME and corporate segments, due to the sharp growth recorded when the pandemic started and the lower need for liquidity.

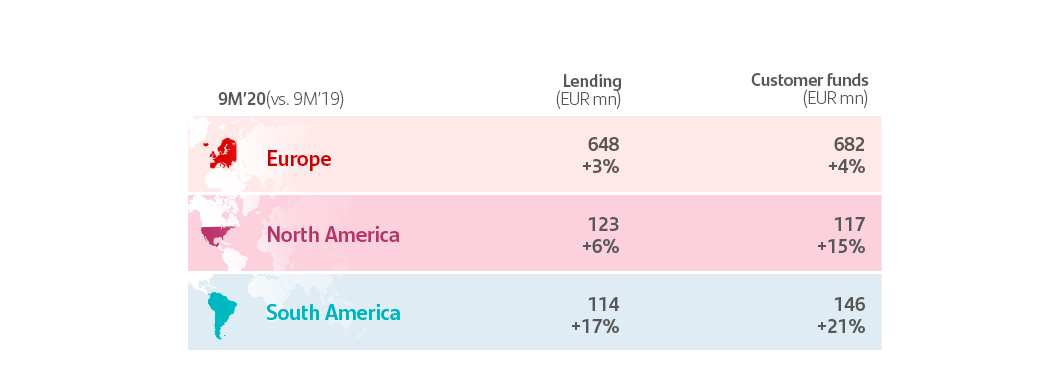

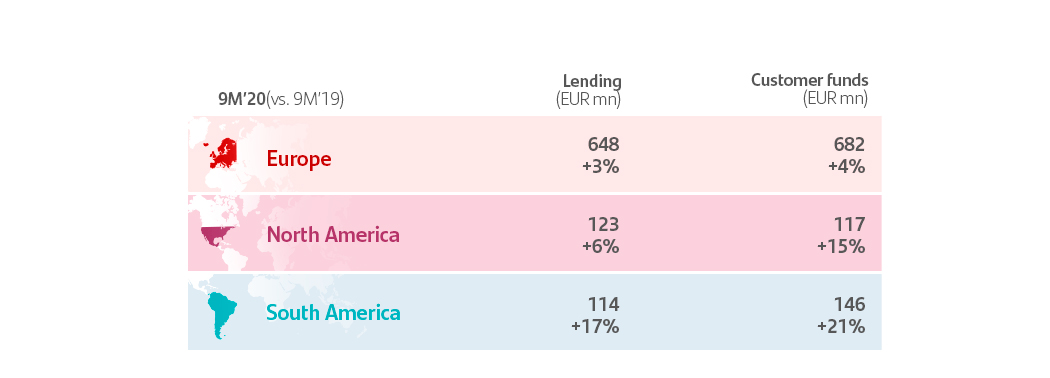

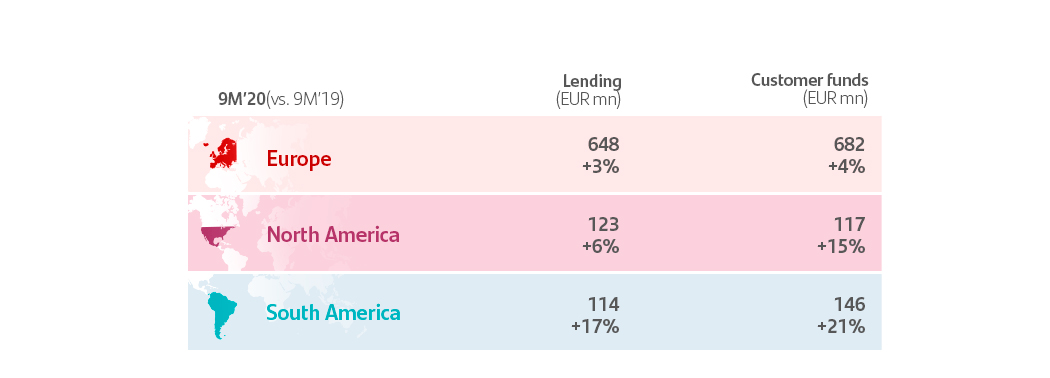

- In volumes, strong negative exchange rate impact (-6/-7 pp) year-on-year. In constant euros, gross loans and advances to customers (excluding reverse repos) grew 5% and customer funds (excluding repos) rose 8%, both with all markets growing.

Note: YoY changes in constant euros.

Business distribution by markets

% operating areas. September 2020EUROPE

| Loans to customers | Customer funds | |

|---|---|---|

| SPAIN | 23% | 33% |

| SCF | 11% | 4% |

| UK | 27% | 23% |

| PORTUGAL | 4% | 4% |

| POLAND | 3% | 4% |

| OTHER EUROPE | 5% | 3% |

NORTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| USA | 11% | 8% |

| MEXICO | 3% | 4% |

SOUTH AMERICA

| Loans to customers | Customer funds | |

|---|---|---|

| BRAZIL | 7% | 10% |

| CHILE | 4% | 4% |

| ARGENTINA | 1% | 1% |

| OTHER SOUTH AMERICA | 1% | 1% |

| Customers funds 1% |

Activity

EUR million| % change vs 9M'19 | |||

|---|---|---|---|

| 9M '20 | EUR | Constant EUR |

|

| Gross loans and advances to customers* | 890,047 | (1.1) | 5.2 |

| Customer deposits** | 801,932 | 3.3 | 9.1 |

| Mutual funds | 155,479 | (11.9) | 1.1 |

| Customer funds | 957,411 | 0.4 | 7.8 |

**Excluding repos.