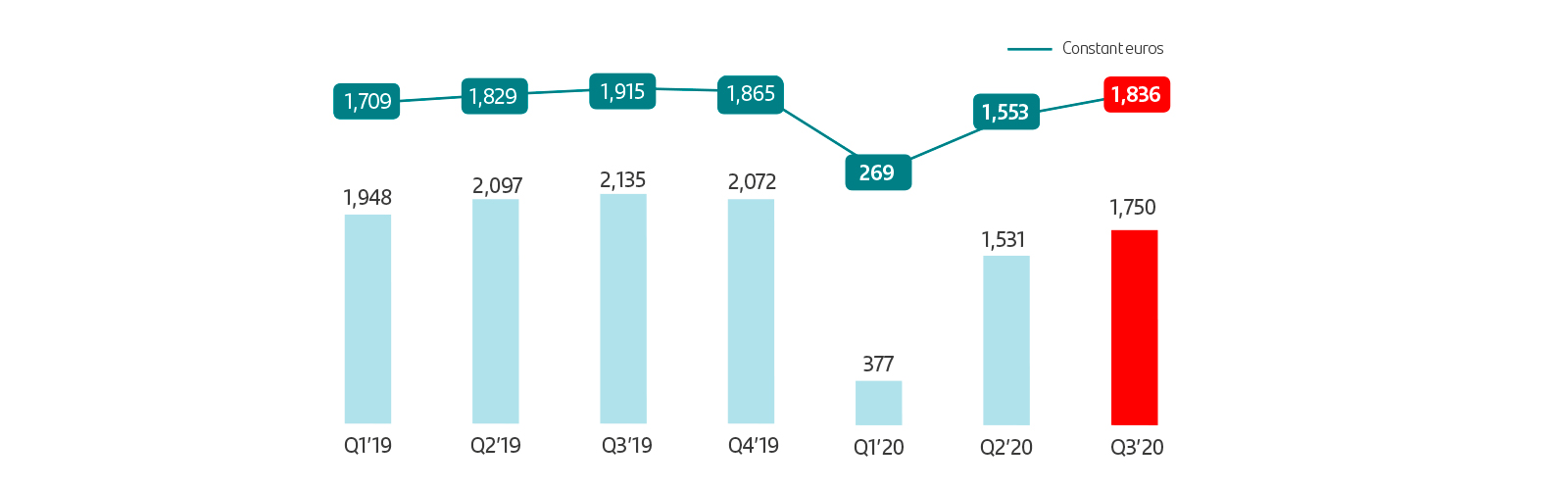

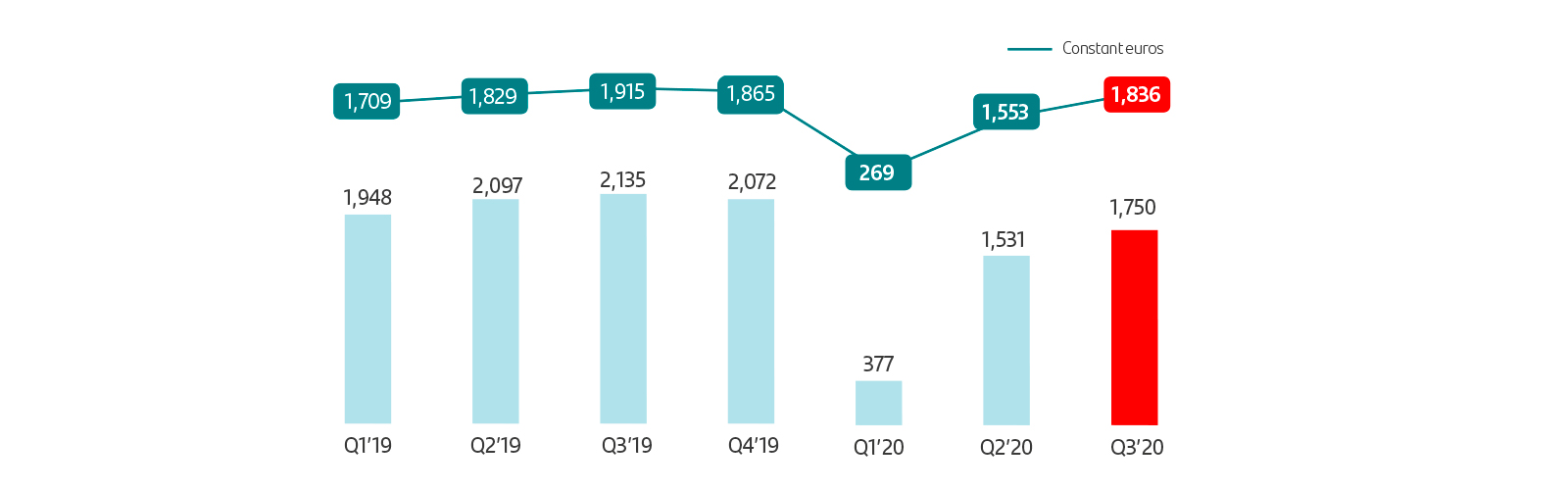

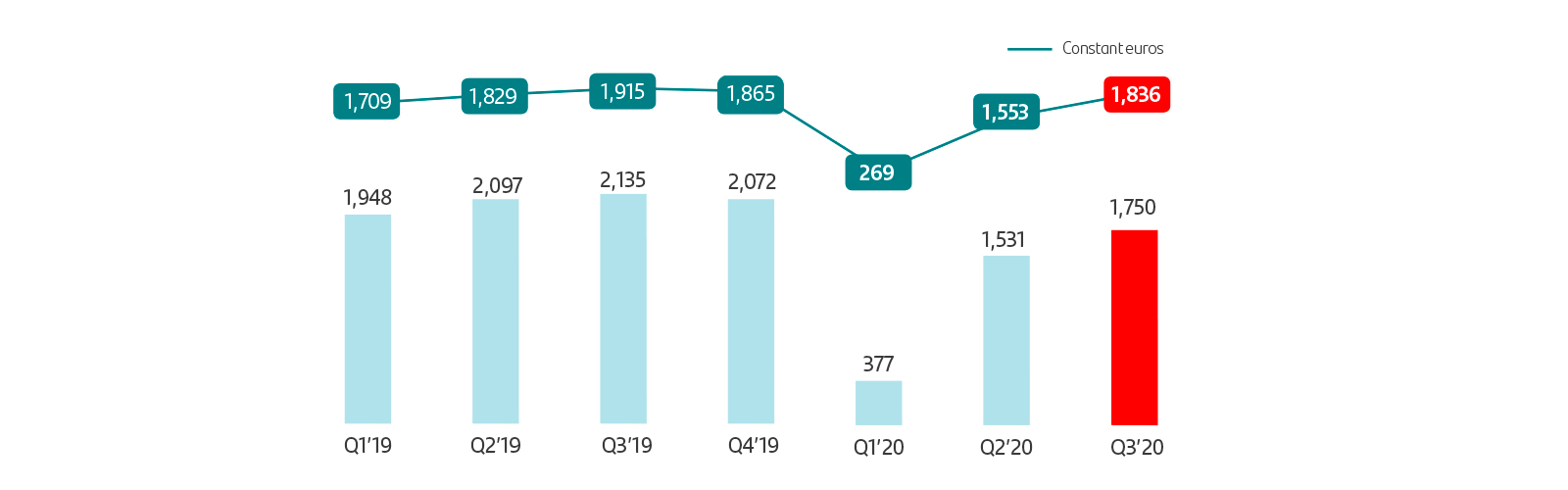

In the third quarter, results recorded a positive performance compared to the second quarter, supported by an upturn in revenue, cost control and lower provisions. This was reflected in a 14% increase in the Group's underlying attributable profit in the quarter to EUR 1,750 million (+18% in constant euros). This improvement was recorded in the three main regions.

As a result of the worsening economic outlook, adjustments to the goodwill ascribed to some units and to deferred tax assets were made in the second quarter totalling EUR 12,600 million, which results in an attributable profit to the Group in the first nine months of 2020 of negative EUR 9,048 million.

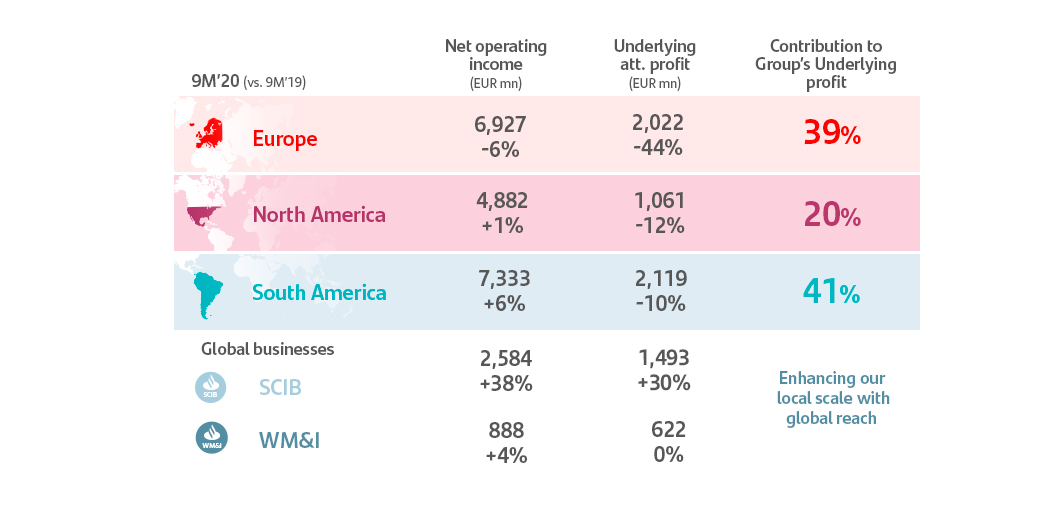

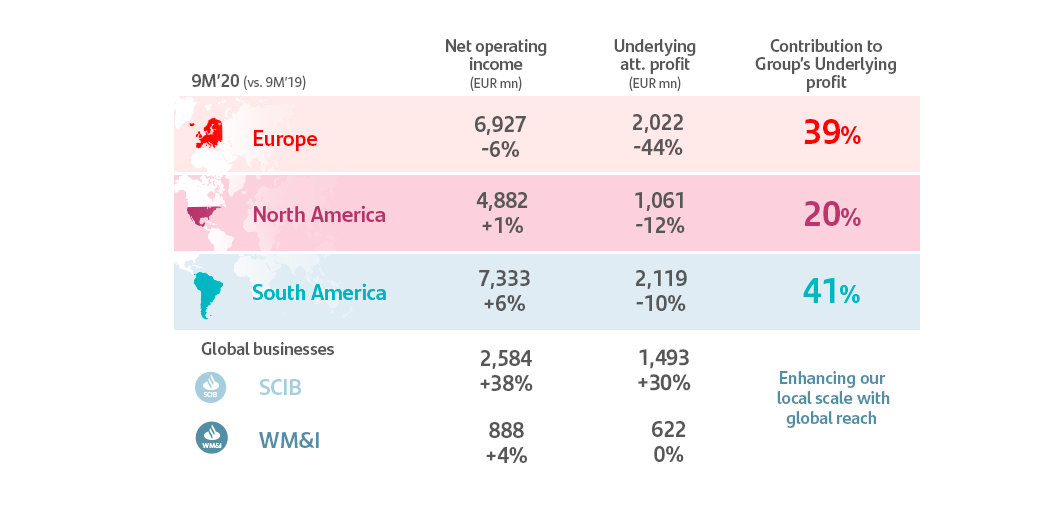

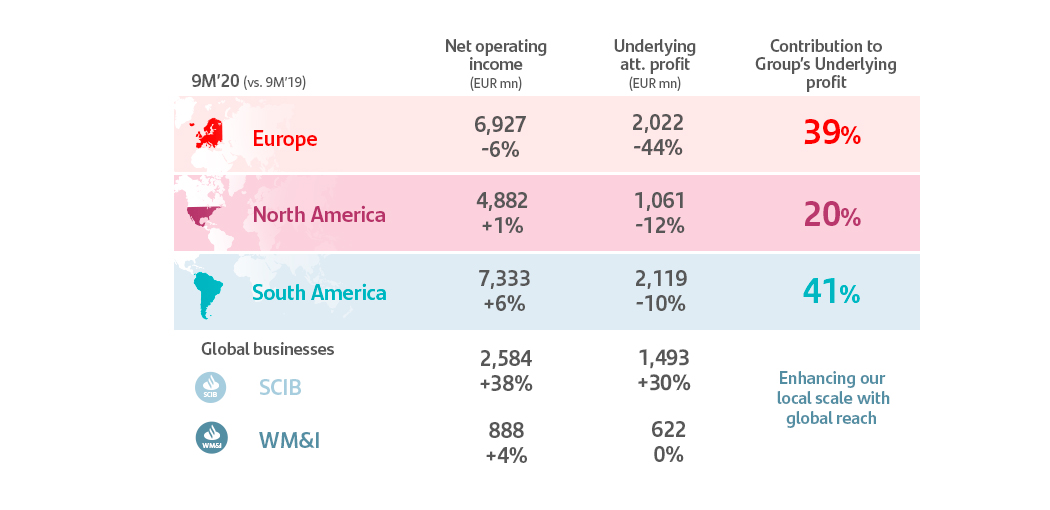

Excluding the above adjustments and restructuring costs, underlying attributable profit in the first nine months of 2020 would have been EUR 3,658 million, 41% less than in the same period of 2019 (-33% excluding the exchange rate impact), with net operating income of EUR 17,879 million, 3% more without the exchange rate impact .