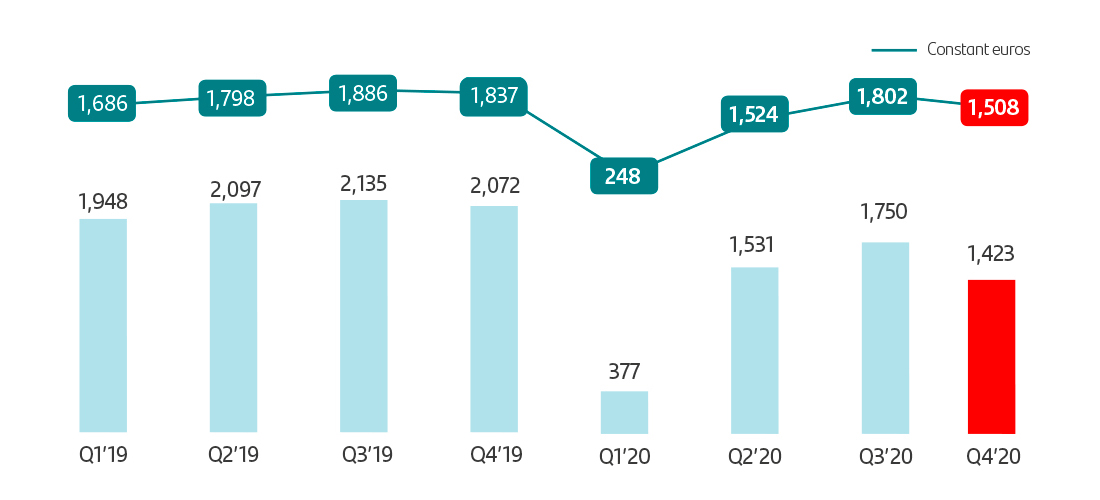

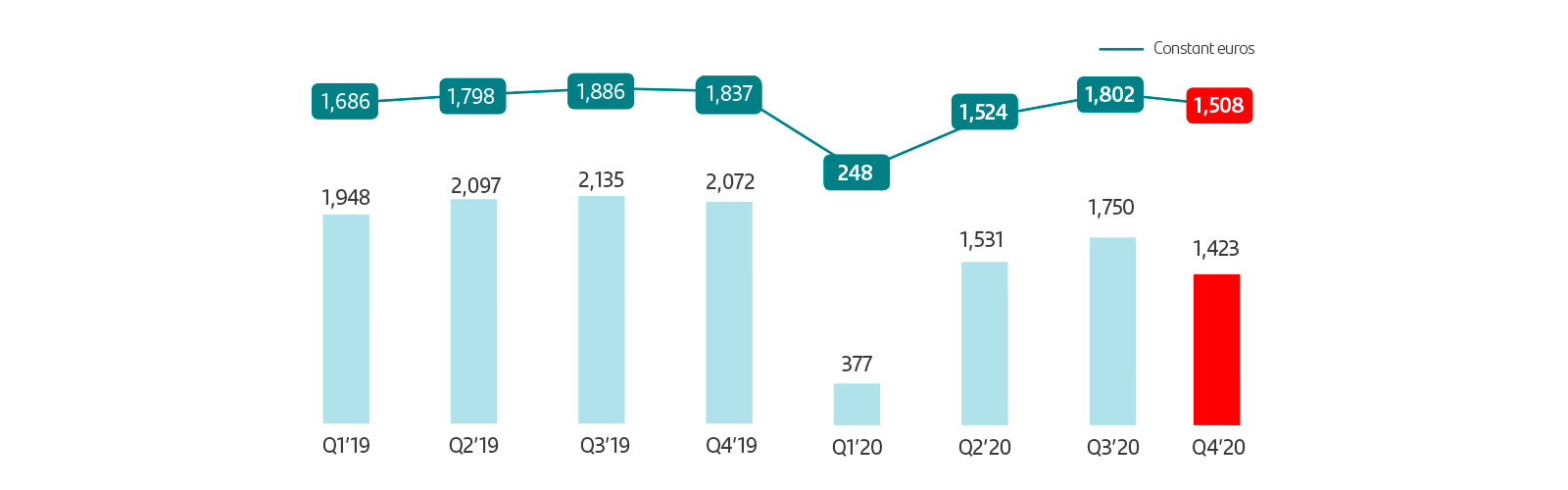

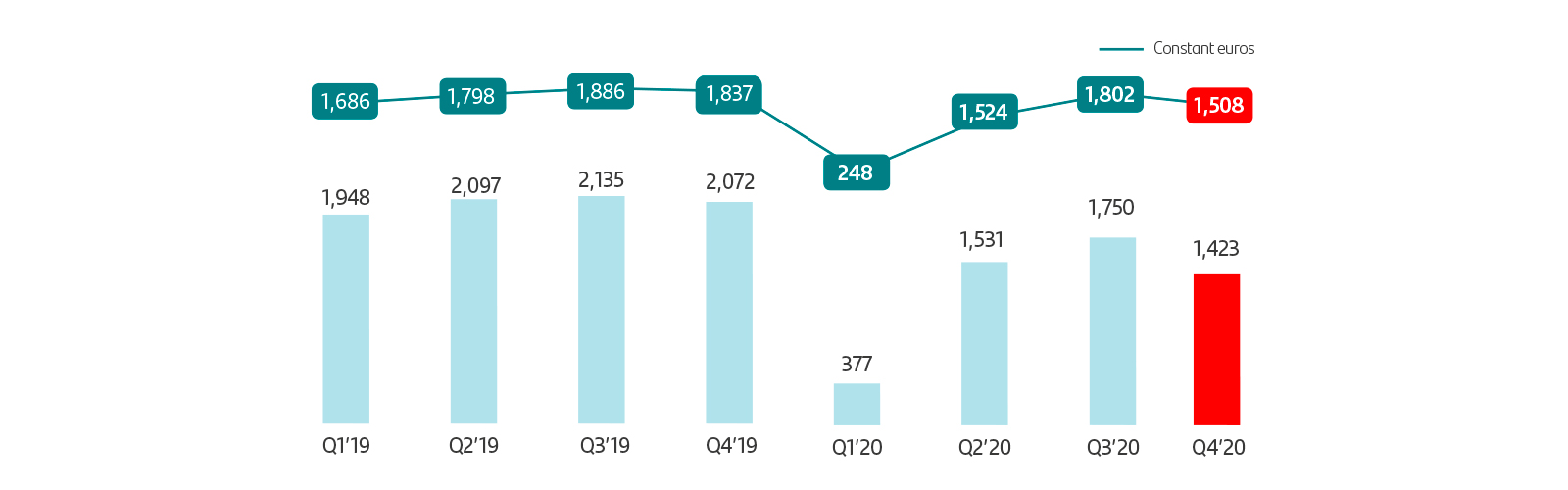

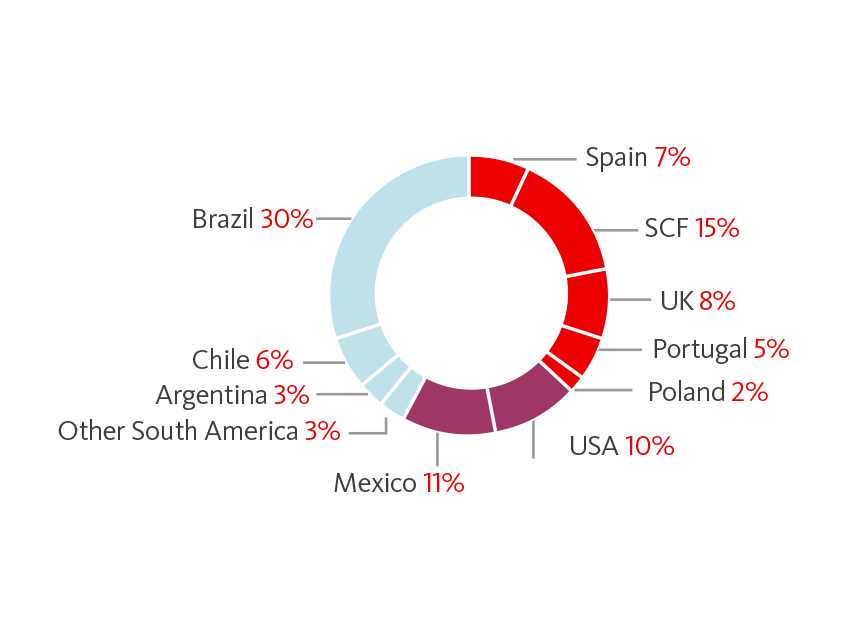

In the year, Grupo Santander's results were affected by the health crisis caused by the spread of covid-19, which is reflected in a weaker economic environment, lower interest rates and a sharp depreciation of some currencies.

As a result of the worsening economic outlook, adjustments to the goodwill ascribed to some units and to deferred tax assets were made in the second quarter totalling EUR 12,600 million. As a result, the Group's attributable profit in 2020 was negative EUR 8,771 million.

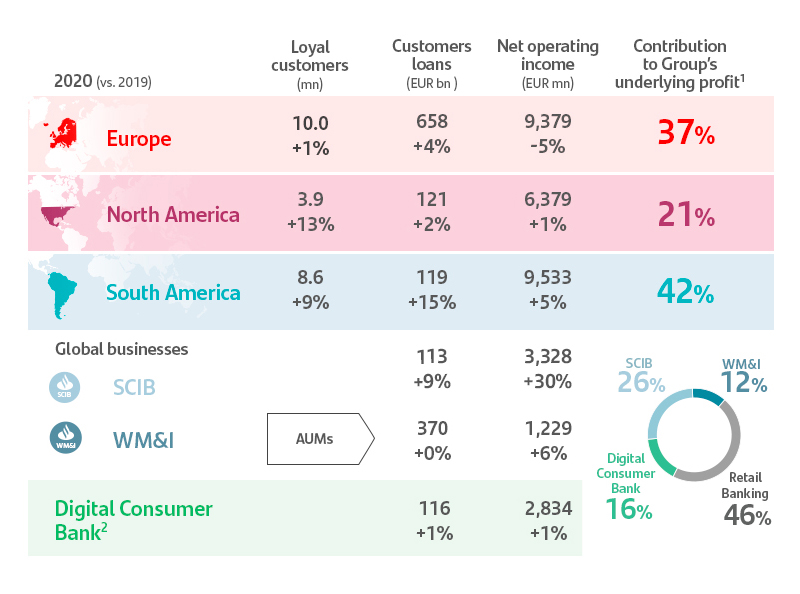

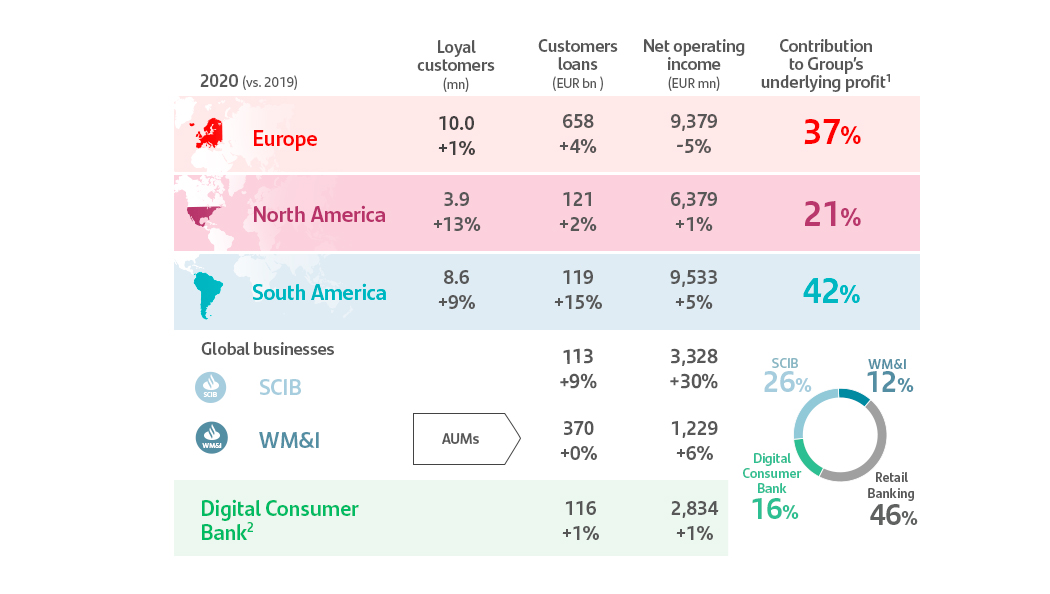

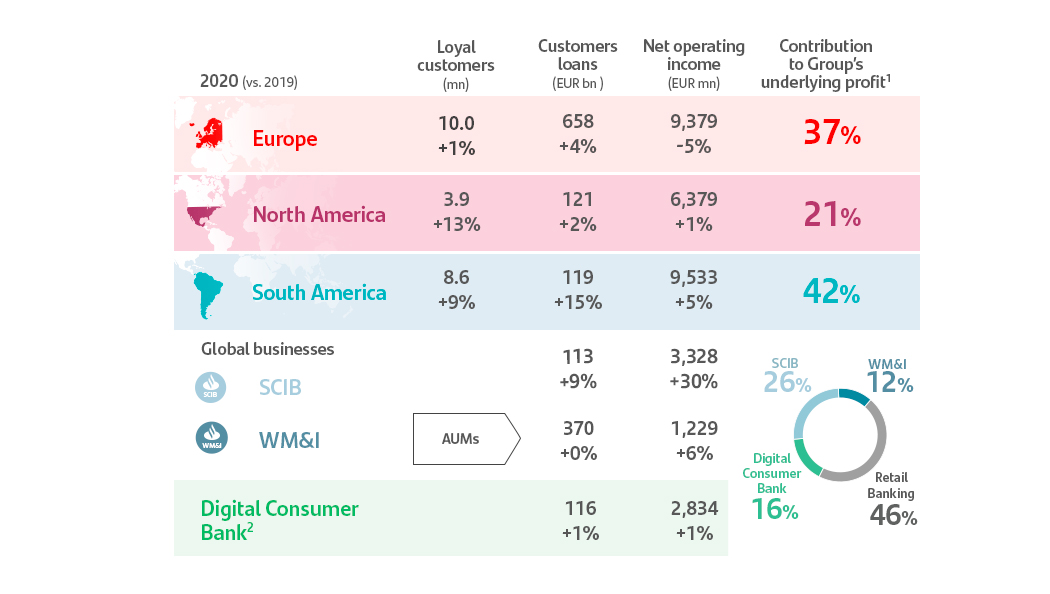

Excluding the above adjustments and restructuring costs, underlying attributable profit was EUR 5,081 million, 38% lower than in 2019 (-29% excluding the exchange rate impact), with net operating income of EUR 23,633 million, 2% more without exchange rate impact than in 2019.